Share Your Harvest With a Gift of Grain

You prepare. You plant. You nurture. You grow. Your fields are more than just a source of abundance. They hold the potential to transform the lives of northwest Missourians and surrounding counties of our region. As a steward of the land, you have a unique opportunity to make a lasting impact through your gift of grain.

Not only can you cultivate change, you can reap tax benefits as well. When you transfer legal ownership of a commodity before it is sold to a charitable organization such as Mosaic Life Care Foundation, you can get significant tax savings.

For example, you avoid having to include the commodity in your income, thus reducing your income taxes. In addition, you may deduct the production costs of the commodity such as seed, fertilizer or irrigation, which results in saving self-employment tax, state income tax and federal income tax.

Complete Your Gift in 5 Simple Steps

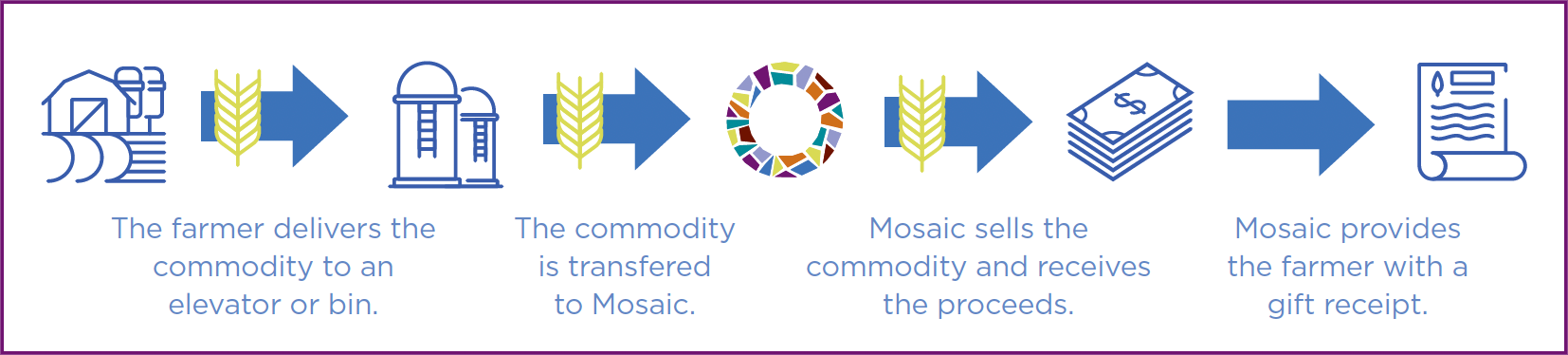

- Inform Mosaic Life Care Foundation that you intend to make a gift of grain, and we will provide you with a pledge form.

- Indicate on your form the quantity and type of grain being contributed and return the form to us.

- Deliver the grain to your local elevator or co-op.

- Request that a storage receipt be issued in the name of Mosaic Life Care Foundation and that the contract to sell the grain be sent to us for signature.

- The check for the sale of the grain will be issued directly to us.

Consult your tax or legal professional prior to making your gift to determine the most effective way to manage your taxes and support the health of deserving communities. If you have any questions about how to make this special gift, contact Julie Gaddie, PhD, President at (816) 271-7200 or julie.gaddie@mlcfoundation.com.